The scope of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) has been expanded.

The government implements new regulations every year to boost compliance, streamline procedures, or handle changes in the economy. To guarantee correct tax returns and take advantage of any potential benefits, it is important to stay updated about these adjustments.

Vikas Dahiya, Director of ALL India ITR, says,, “While the core filing process might seem familiar, even minor adjustments in regulations can significantly impact your tax calculations, deductions, and potential refunds.” He also highlights three important improvements that may have an effect on how you file your ITR in 2024.

Changes in tax slabs and rates

The optional new tax regime, which offers lower tax rates without exemptions and deductions, has seen the introduction of new tax slabs by the government this year. The previous system, which included a number of exemptions and deductions, is still available to you. The new regime, on the other hand, streamlines the procedure but does away with the majority of deductions. To decide which regime is better for your financial condition, it's critical to compare the two.

Standard Deduction for Pensioners

Pensioners now have access to a new standard deduction of Rs 50,000. This covers pension income and offers assistance akin to that which is given to salaried workers. Retirees should be careful to take this deduction to lower their taxable income.

Changes in Section 80C and 80D limits

The maximum amount that may be invested in PPF, NSC, and life insurance premiums under Section 80C is still Rs 1.5 lakh. Nonetheless, there has been a drive to encourage digital savings and payments in the healthcare industry, as seen by the higher Section 80D medical insurance cap limitations. Higher tax deductions are now available to taxpayers for health insurance premiums paid for older parents, families, and themselves.

Updated TDS and TCS provisions:

The scope of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) has been expanded. Notable changes include new TDS rates for non-salaried individuals and professionals and additional compliance requirements for e-commerce transactions. Taxpayers must review their TDS certificates and ensure that appropriate credits are claimed in their ITR.

Higher deduction for home loan interest:

The extra deduction of Rs 1.5 lakh for interest on house loans taken out under Section 80EEA has been extended for first-time homebuyers. In addition to offering taxpayers with new house loans significant relief, this attempts to promote home ownership.

Faceless assessment and appeals:

To decrease human interaction and increase openness, the government has extended the channels for faceless assessments and appeals. It is advisable for taxpayers to acquaint themselves with the processes and guarantee that they complete all online submissions and notice responses within the designated time frames.

Enhanced reporting requirements:

The updated ITR forms now incorporate more disclosures, particularly with regard to overseas income and assets as well as big transactions. Taxpayers who have substantial financial operations or investments abroad must submit comprehensive information in order to avoid fines.

Relief for senior citizens:

For seniors 75 years of age and above, who exclusively get interest income from their pension, they do not need to file an ITR as long as the bank takes off the mandatory tax. For elderly people with clear-cut sources of income, this simplicity lessens the compliance load.

![submenu-img]() After his arrest in murder case, Darshan lands in more legal trouble; Kannada star will now be charged for...

After his arrest in murder case, Darshan lands in more legal trouble; Kannada star will now be charged for...![submenu-img]() DNA TV Show: Who is the mastermind of alleged NEET-UG paper leak?

DNA TV Show: Who is the mastermind of alleged NEET-UG paper leak?![submenu-img]() Meet man who gets Rs 12.50 crore salary, runs Rs 318000 crore company backed by Ratan Tata

Meet man who gets Rs 12.50 crore salary, runs Rs 318000 crore company backed by Ratan Tata![submenu-img]() Neeraj Chopra wins gold in javelin at Paavo Nurmi Games 2024 with throw of...

Neeraj Chopra wins gold in javelin at Paavo Nurmi Games 2024 with throw of...![submenu-img]() 'Modi ji won't be intimidated': Taiwan after China objects to ties with India

'Modi ji won't be intimidated': Taiwan after China objects to ties with India![submenu-img]() Meet man who cracked NEET-UG at 50 but there is a twist...

Meet man who cracked NEET-UG at 50 but there is a twist...![submenu-img]() Meet IIT-JEE topper, went to IIT Bombay with AIR 1, got job with Rs 70 lakh salary, left it to become a…

Meet IIT-JEE topper, went to IIT Bombay with AIR 1, got job with Rs 70 lakh salary, left it to become a…![submenu-img]() 'If there is 0.001% negligence on the part of anyone it...': SC issues notices to NTA, Centre over NEET-UG

'If there is 0.001% negligence on the part of anyone it...': SC issues notices to NTA, Centre over NEET-UG ![submenu-img]() Meet doctor who cracked UPSC exam, became IAS officer but resigned after seven years due to...

Meet doctor who cracked UPSC exam, became IAS officer but resigned after seven years due to...![submenu-img]() NEET-PG 2024 admit card to be released today; check steps to download

NEET-PG 2024 admit card to be released today; check steps to download ![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Triptii Dimri sets the internet on fire in black bikini in beachside photos, fans say 'bhabhi bani baby'

Triptii Dimri sets the internet on fire in black bikini in beachside photos, fans say 'bhabhi bani baby'![submenu-img]() In pics: Ananya Panday dazzles in shimmery green mini dress, poses with Gwyneth Paltrow at Swarovski event in Milan

In pics: Ananya Panday dazzles in shimmery green mini dress, poses with Gwyneth Paltrow at Swarovski event in Milan![submenu-img]() In pics: Sonakshi Sinha's black-themed bachelorette with Huma Qureshi, Zaheer Iqbal's secret bachelor party

In pics: Sonakshi Sinha's black-themed bachelorette with Huma Qureshi, Zaheer Iqbal's secret bachelor party ![submenu-img]() From Jawan to Munjya, 5 films that showcased exceptional VFX and ruled box office recently

From Jawan to Munjya, 5 films that showcased exceptional VFX and ruled box office recently![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() After his arrest in murder case, Darshan lands in more legal trouble; Kannada star will now be charged for...

After his arrest in murder case, Darshan lands in more legal trouble; Kannada star will now be charged for...![submenu-img]() Darshan arrest: Pavithra Gowda, co-accused seen smiling during investigation, furious netizens say 'no regret, no guilt'

Darshan arrest: Pavithra Gowda, co-accused seen smiling during investigation, furious netizens say 'no regret, no guilt'![submenu-img]() Meet Captain GR Gopinath, inspired Akshay Kumar's Sarfira, served in Indian Army, founded India's first low-cost airline

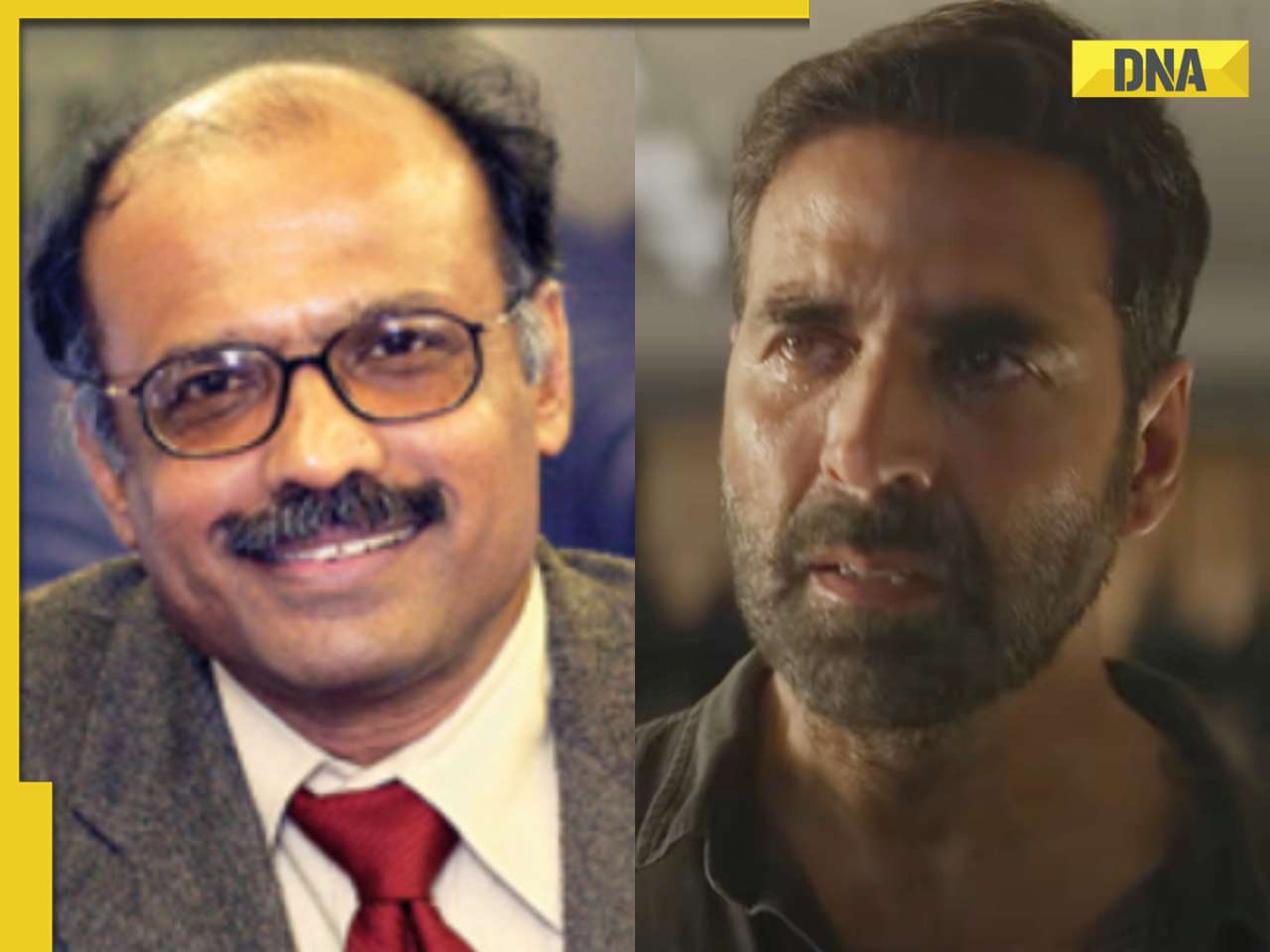

Meet Captain GR Gopinath, inspired Akshay Kumar's Sarfira, served in Indian Army, founded India's first low-cost airline![submenu-img]() Justin Timberlake arrested for drunk driving in New York, details inside

Justin Timberlake arrested for drunk driving in New York, details inside![submenu-img]() The Iron Claw review: Brilliant cautionary tale of parental pressure; and a tribute to wrestling's most 'cursed' family

The Iron Claw review: Brilliant cautionary tale of parental pressure; and a tribute to wrestling's most 'cursed' family ![submenu-img]() Country with most number of pyramids, it's not Egypt

Country with most number of pyramids, it's not Egypt![submenu-img]() Mukesh Ambani, Nita Ambani's son Anant Ambani and Radhika Merchant's wedding festivities to start on...

Mukesh Ambani, Nita Ambani's son Anant Ambani and Radhika Merchant's wedding festivities to start on...![submenu-img]() Glaring safety innovation: Finland adopts reflective coating on reindeer antlers to curb road collisions

Glaring safety innovation: Finland adopts reflective coating on reindeer antlers to curb road collisions![submenu-img]() Viral video: Elephant calves sleep under ‘Z++ security’ as herd protectively stands guard

Viral video: Elephant calves sleep under ‘Z++ security’ as herd protectively stands guard![submenu-img]() This man owned Rs 248 crore necklace, first Indian to buy airplane, was wealthier than Mukesh Ambani, Ratan Tata...

This man owned Rs 248 crore necklace, first Indian to buy airplane, was wealthier than Mukesh Ambani, Ratan Tata...

)

)

)

)

)

)

)